Taxation in India used to be a complex web of multiple indirect taxes, making it difficult for businesses to operate efficiently. That changed with the introduction of the Goods and Services Tax (GST). As we move through 2026, the GST regime has evolved further to become more streamlined and business-friendly.

If you are an entrepreneur, a student, or an online seller, understanding GST is no longer optional—it is a survival skill. In this guide, we will break down exactly what GST is, how the updated tax slabs for 2026 work, and what every business owner needs to know to stay compliant.

For businesses looking to scale without getting bogged down by compliance, agencies like Dream Grow Digital offer specialized support, ensuring your digital footprint grows while your tax worries shrink.

What is GST in India?

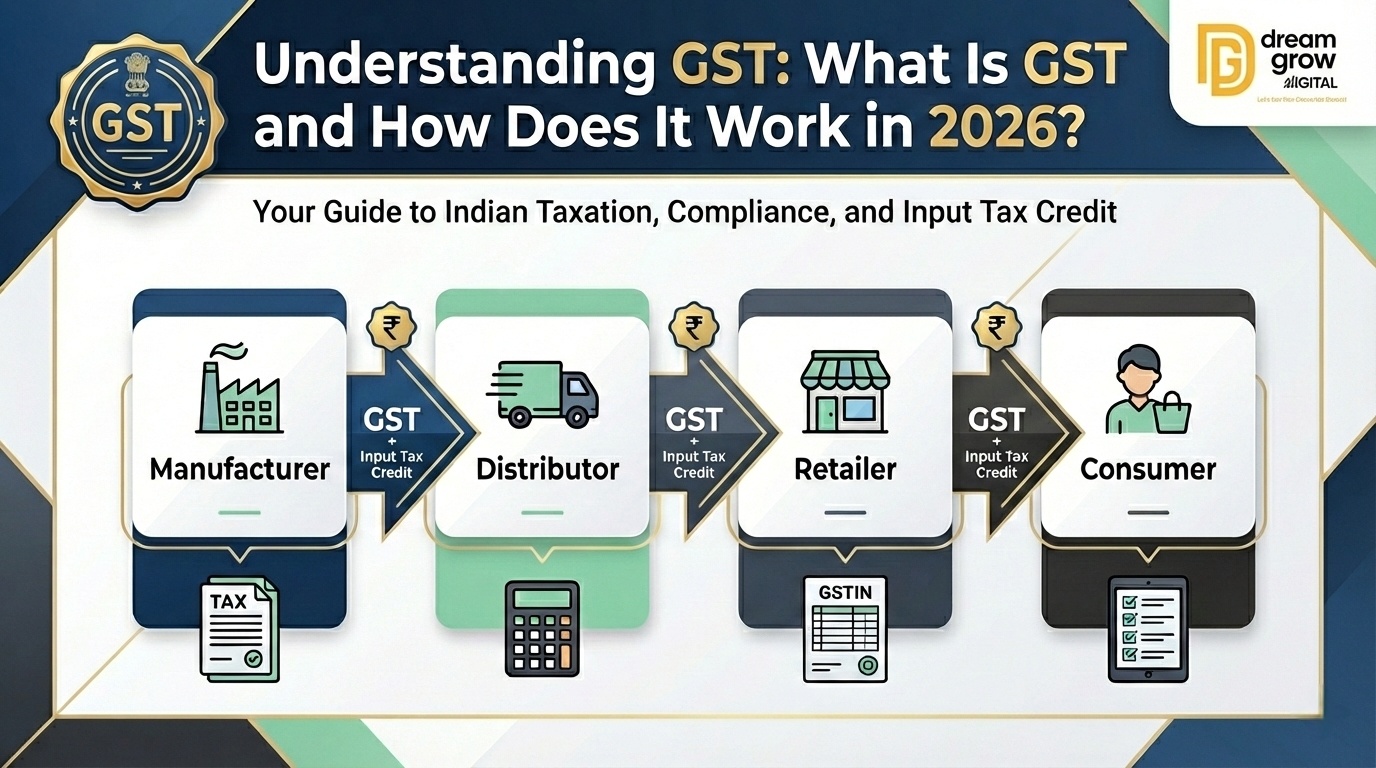

GST, or Goods and Services Tax, is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. In simple words, it is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

Before GST, India had a "cascading" tax structure where you paid tax on tax (e.g., Excise, VAT, Service Tax). GST replaced these with a unified system, turning India into "One Nation, One Tax."

Why Was GST Introduced?

The primary goal was to remove the cascading effect of taxes and simplify the compliance burden. In 2026, the system has matured significantly, with automation now driving most compliance processes. The focus has shifted from mere implementation to "Ease of Doing Business," especially for the booming e-commerce sector.

The Components of GST

To respect India's federal structure, GST is divided into three main components. Understanding GST requires knowing which component applies to your invoice:

- CGST (Central Goods and Services Tax): Collected by the Central Government on intra-state sales (e.g., a sale within Uttar Pradesh).

- SGST (State Goods and Services Tax): Collected by the State Government on intra-state sales.

- IGST (Integrated Goods and Services Tax): Collected by the Central Government on inter-state sales (e.g., selling from Delhi to Mumbai).

- UTGST (Union Territory Goods and Services Tax): Applicable when the transaction takes place in a Union Territory (like Chandigarh or Ladakh).

How GST Works for Businesses in 2026

In 2026, the GST workflow will be highly digitized. Here is the standard lifecycle:

- Purchase: You buy raw materials and pay GST.

- Value Addition: You manufacture a product or add a service margin.

- Sale: You sell the final product and collect GST from the customer.

- Offset: You pay the difference between the tax collected (Output Tax) and tax paid (Input Tax) to the government.

The Input Tax Credit (ITC) Mechanism

This is the heart of GST. ITC allows businesses to claim credit for the GST paid on business purchases.

- Example: If you are a shirt manufacturer, you pay tax on purchasing fabric (Input Tax). When you sell the shirt, you collect tax (Output Tax). You only pay the government the balance (Output minus Input).

- 2026 Update: ITC claims are now strictly validated against your supplier’s filings (GSTR-2B). If your supplier doesn't file, you cannot claim the credit.

GST Slabs in India (2026 Updated)

The GST Council has rationalized rates to simplify the structure. As of 2026, the tax slabs have been streamlined to reduce confusion and boost consumption.

| Slab Rate | Category of Goods/Services |

| 0% (Nil Rated) | Essentials like fresh milk, vegetables, unbranded flour, and life-saving medicines. |

| 5% | Mass consumption items like packaged food, footwear (under ₹1000), and economy air travel. |

| 12% | Processed foods, mobiles, and specific apparel. |

| 18% | The standard rate for most manufactured goods, electronics, and IT services. |

| 28% + Cess | Luxury items like high-end cars, aerated drinks, and tobacco products. |

Note: The government is actively discussing a shift toward a 3-tier structure (5%, 18%, 40%) to further simplify this list in the coming fiscal year.

GST for Ecommerce Sellers: A 2026 Perspective

The e-commerce sector has seen the most significant relaxations. If you sell online, here is what you must know:

1. Mandatory Registration (With Relaxations)

Historically, any online sale required immediate GST registration. However, recent rules allow small intra-state sellers (selling only within their own state) with a turnover of less than ₹40 Lakhs to sell online with just an Enrollment ID, sparing them from complex filings.

2. Inter-State Sales

If you sell across state lines (e.g., on Amazon/Flipkart to customers nationwide), mandatory GST registration still applies regardless of your turnover.

3. TCS (Tax Collected at Source)

E-commerce platforms (like Amazon) deduct 1% TCS on your net taxable sales and deposit it with the government. You can claim this amount as a credit in your cash ledger.

Pro Tip: Managing these multi-channel compliances can be tricky. Dream Grow Digital helps sellers and businesses with professional ecommerce account management and compliance support, ensuring your product listings are live and your taxes are filed without errors.

Who Needs to Register for GST?

Not everyone needs a GST number. The registration thresholds for 2026 are:

- Service Providers: Mandatory if annual turnover exceeds ₹20 Lakhs (₹10 Lakhs for special category states).

- Goods Suppliers: Mandatory if annual turnover exceeds ₹40 Lakhs (₹20 Lakhs for special category states).

- Voluntary Registration: You can register voluntarily to claim Input Tax Credit even if your turnover is lower.

The registration process is fully digital. You can complete your GST Registration Online through the official government portal, often receiving your GSTIN within 3-7 working days.

Conclusion

Understanding GST is the first step toward building a compliant and profitable business in India. While the system has become more automated in 2026, the core principle remains the same: transparency. Whether you are a small trader or a growing e-commerce brand, staying updated with these tax structures ensures you avoid penalties and maximize your profits through ITC.

Ready to streamline your business?

Don't let tax complexities hold your growth back. Ensure your paperwork is in order and focus on what you do best—selling.

Frequently Asked Questions (FAQs)

Q1: Can I modify my GST registration details later?

Yes, non-core fields can be amended easily. Core fields (like business names) require approval from a tax officer.

Q2: What is the penalty for not filing GST returns?

In 2026, late fees are auto-calculated by the portal. You cannot file the current month's return without clearing previous dues and late fees.

Q3: Is GST applicable to freelancers?

Yes, if a freelancer’s income exceeds ₹20 Lakhs (or if they provide inter-state services), they must register.

Q4: How does GST help in reducing prices?

By eliminating the "tax-on-tax" system and allowing Input Tax Credit, the overall production cost drops, which can lead to lower prices for end consumers.